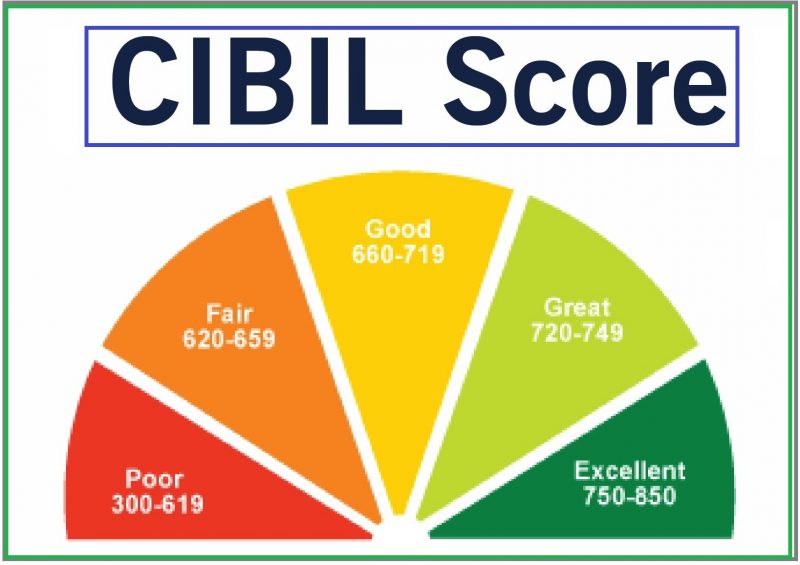

A low credit score gets you down when it comes to borrowing experience. There are various negative impacts of having a low credit score. An ideal credit score is above 750, and you must improve your credit score for a better borrowing experience. Here’s how a negative CIBIL score calculation can affect your entire borrowing experience:

The Negative Effects of a Low Credit Score

- An expensive loan: A low credit score always pulls you down in terms of financial independence. An individual without a good credit score is always a risky borrower in the eyes of the loan provider. Therefore, the loan costs will always be high for individuals with low credit scores. Individuals with low scores indicate risk, low credit health, and bad financial activities related to past loan repayments. Therefore, to recover lost loans, providers would offer a high rate of interest to recover the maximum amount within a short span of time. This makes any loan very expensive. This pulls you down and does not allow you to get an affordable loan. A high rate of interest always makes a loan expensive, and you will have a high monthly instalment to pay every month.

- Loan denial: A low credit score does not allow you to get loan approval. Individuals are eligible only on the basis of a high credit score and a couple of other factors. Without a high credit score, it becomes difficult for the loan provider to approve the loan application. This directly leads to a loan denial. A low credit score indicates that the individual has missed payments, defaulted on past repayments, and engaged in various financial activities that are in violation of the individual’s credit score. Therefore, in order to avoid risk, loan providers generally deny your loan request. This prevents you from obtaining a loan for any reason. The approval process for unsecured and high-value loans is extremely stringent and is based on free credit scores.

- Loan disbursement amount: Only when you are eligible can you get the desired amount of money sanctioned as a loan. It is vital to fulfilling your eligibility criteria so that you can get the amount you need. Generally, for low-credit-score individuals, the sanctioned amount is much less than what they desire. Individuals with good credit scores become an asset to the loan provider. Therefore, the loan sanction amount matches the desired amount as there is no risk at all. Individuals with a high credit score are always trusted by financial institutions. On the other hand, with a low credit score, you will not be getting the amount that you need. Generally, 60-70% of the desired amount is sanctioned for individuals with low credit scores.

- No negotiation: Negotiation is a great way to make your loan affordable, favorable, and smooth. This power to negotiate with the loan provider comes only from a high credit score. You need to be eligible in terms of credit score to negotiate with your loan provider. Starting from the rate of interest, tenure, EMI, charges, and terms and conditions, you can negotiate on all of them. However, individuals with low credit scores will not be able to negotiate. Without negotiation, you will end up with an expensive rate of interest and terms and conditions that are imposed by the loan provider.

Boost your credit score

- Pay bills timely: If you are having a low credit score, it is high time that you start building your credit score. The best way to start is with a disciplined payment approach. Make your payment on or before the due date. Do not delay or miss the due dates.

- Keep no outstanding amount: When you pay your monthly instalment or credit card bills, there should not be any outstanding or overdue. So, you need to pay the full bill amount and not the minimum balance. This makes your loan expensive as well as damages your CIBIL score calculation.

- Don’t apply for multiple loans: Do not apply for multiple loan applications within a short span of time. If you have gotten a rejection, stop applying and start working on loopholes. It is important to build your credit score by managing your application.

- Keep your credit account open: The longer you keep your credit account open, the better the free credit score will be. Even if you do not use your credit card, you can keep it open. This is more applicable if you have a credit account with a long history.

- Check credit score: Check your credit score at random to improve your score by detecting errors and negative comments. Regular credit score checks will help you improve your score and monitor the improvement in a better way.

- Credit mix: In order to improve your credit score, you should have a well-balanced credit mix. It is important to saturate your credit profile with both secured and unsecured loans. Do not focus on any single type of loan alone.

Finishing up

CIBIL score calculation is essential for improving your credit score. Initiate a free credit score check to detect errors and improve your credit health and financial stability. Visit Clix Capital for an instant, free credit score check option.

You may also read: Best Investment Options That Can Boost Your Income

More Stories

Best Investment Options That Can Boost Your Income

Dos and Don’ts of Applying for a Loan against Property (LAP)

What Is a Mortgage Loan? Learn Basics for Beginners